Turbotax Problems 2021 - We independently check everything we recommend. When you make a purchase through our links, we may receive a commission. Learn more>

Doing taxes may not be fun, but the right tool can turn the worst chore of the year into a manageable — and, dare we say, rewarding — afternoon. The best tax software makes sure you get the credits and deductions you deserve, without dragging you to hell. After testing six online tax planners, we can say with confidence that TurboTax Free Edition is the most complete, accurate, and simple tool for the job.

Turbotax Problems 2021

Because of its superior step-by-step tax guidance, TurboTax has been one of our top picks since we first reviewed tax software in 2013. But there are two situations where we think you should take a different approach:

Turbotax Cannot File Your Taxes If Your State Income Is Higher Than Your Federal Income

Finally, if you really don't want to spend money filing your taxes — no matter how much the software might make you want to tear your hair out — MyFreeTaxes (backed by the United Way and powered by TaxSlayer as a platform) is completely free. and has no income or age limits. It's not the most user-friendly software, so we recommend it only if you're comfortable researching tax information yourself rather than getting help from the software. You can learn more about that option in our Featured Contests section.

TurboTax Free Edition is the most sophisticated tax software available, and most people don't need to pay for Deluxe if they take the standard discount.

TurboTax is the best tax software online because of its intuitive and intelligent reporting process. Even though TurboTax insists we say the free version is "for basic tax returns only" and that "not all taxpayers are eligible" — even though the company recommends TurboTax Deluxe if you want to "add tax credits and credits" (which is t?) — we think most people should start with the free version. Even if you have other deductible expenses, like mortgage interest or charitable donations, it's best to start here and upgrade to Deluxe only if necessary.

The reason is simple, though not obvious if you've never used TurboTax before: If you start with TurboTax Deluxe and enter all your information only to find that the standard deduction is more important than itemization, then you have to pay Deluxe. fee ($39 at time of writing, plus $40 per country) or delete all data and start over with the free version. Thanks to the Tax Cuts and Jobs Act passed a few years ago, many people will benefit from taking the standard deduction (90% of taxpayers claimed the standard deduction in 2019).

Ftc Accuses Intuit Of Deceptively Advertising Turbotax As Free

There is one exception though. If you have simple repayments and student loan interest or school fees, you should sign up for free with H&R Block Free Online instead. The free version of TurboTax does not cover filing with these discounts.

H&R Block isn't as easy to use as our top picks, but it lets you claim college tuition and student loan interest deductions for free. Use it if you only have a few more forms to enter.

Student loan interest and tuition and fees are important deductions you can take even if you file with the standard deduction. Unfortunately, our top choice, TurboTax Free Edition, does not support filling out these forms. H&R Block Free Online does just that. If you only have these student forms and a few other forms to file, like W-2s and bank statements, this is the best way to file for free.

In our testing, we found H&R Block's help screen and in-app instructions to be about the same as TurboTax's. However, there were many bugs in the software, especially since the payments were complicated. We had some trouble searching for anomalous species and the chat help didn't work. For those reasons, we recommend using H&R Block Free Online to save money as long as you bring a basic report with a student loan or student discount.

Intuit Turbotax Deluxe, E File And State 2022 For Windows

Our Recommendations for Self-Employed People with Complex Payrolls: Certified Public Accountant (CPA) or Enrolled Agent (EA)

Like auto repair, home improvement, and first aid, there are situations where DIY makes sense and then there are situations where it's better. If you are self-employed or own a business, if you manage rental properties, or if you have more complex investments than capital gains or dividends, finding a good tax professional can save you time and stress.

Although the services of a tax preparer may cost you more than the most expensive DIY tax software - CPA fees vary depending on where you live and the complexity of the return. You - get more value out of that expensive ticket. Once you open your forms and documents, the pro enters your data for you, which not only saves time but also prevents DIY mistakes. Additionally, their prices are often ahead of most online software, which often tries to upsell you. Building a relationship with a professional that you can trust for years to come is also very important.

We'd be remiss if we didn't solve the problems many people have with big tax software companies like TurboTax and H&R Block. Both companies have faced numerous lawsuits and investigations regarding marketing, advertising and other business practices. Adding to that public mistrust, many who filed 2019 tax returns at these companies did not receive their incentive payments (although according to the IRS, this was often because the payments were made into bank accounts that were closed or no longer active).

Some Turbotax Users Say A Single Checked Box Kept Them From Getting A Stimulus Check

It's not the same thing, and we're not trying to excuse bad business practices, but as any publisher says, all tax software options have their drawbacks. TurboTax is arguably the easiest, yet most accurate and efficient way to file your taxes yourself. But if you have doubts about using that service and want to do your own taxes, you can use MyFreeTaxes (which is actually a free version of TaxSlayer, sponsored by the United Way), use one of the IRS Free File partners, or fill out manually. Free fillable IRS forms (even the government apparently likes alliteration). These options offer a little more manual handling and have more annoying links than TurboTax and H&R Block, which means you can make more mistakes, but they're completely free. For live assistance, the IRS provides Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) assistance from qualified volunteers for those who qualify. (Generally, you need to earn $57,000 or less, have a disability, or speak limited English.)

This is the eighth year Wirecutter has reviewed and recommended online tax preparation software, and the second time I've worked on the guide as Wirecutter's senior writer. For more than five years before joining Wirecutter, I wrote extensively about personal finance for sites like Lifehacker, SmartAsset, and MyBankTracker. Topics I've covered include when to hire a tax professional, the biggest deduction you should claim and what you should do to make the audit process less stressful, reviews and, yes, tax software comparisons.

Over the years, I have personally used a variety of tax preparation tools and worked with tax professionals to prepare complex financial incomes, including self-employment income, business deductions (including office expenses), profit and loss, home ownership, student loans, and dependent care. I am one of the 34% of Americans who actually like or want to do their taxes, but I also sympathize with those who just want to do their taxes. While researching this guide, I've been keeping an eye on major tax changes for the 2020 tax year and signed up for alerts from the IRS.

The best way to file your tax return is electronically, and you should do it as soon as possible. It will get you your refund faster and can help prevent identity theft. For the 2022 tax year, you should do this especially if you need incentive payments; this also applies to households that normally do not have to file federal taxes. Need further convincing that you should register electronically? The IRS still has more than 10 million tax returns in the mail from last year, plus the pandemic.

Second Stimulus Problems: Turbotax Expects 'most' Customers To Receive Stimulus Payments Today After They Were Put In Wrong Accounts

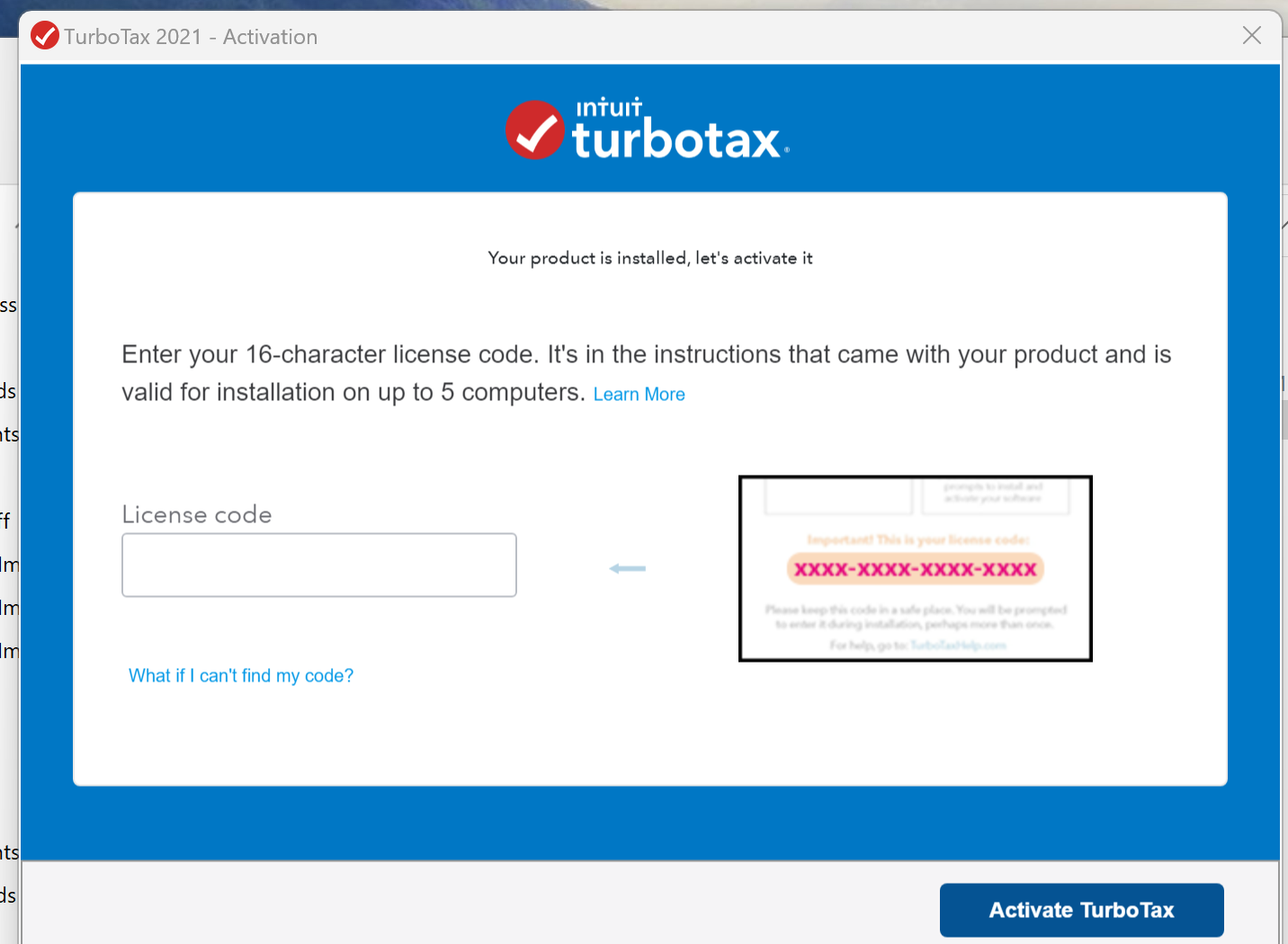

Online tax software can simplify the task of doing your own taxes and filing electronically, and it's cheaper than hiring a professional. A few companies offer computer tax software, but these packages tend to be more expensive and are worth the investment if you need to work offline or have multiple systems. return (The downloadable TurboTax Basic program, $40 in this book, is comparable to TurboTax Free Edition except that it includes five federal e-filings and state e-filings). You will also need to repurchase the computer software each year to keep up with tax changes.

The online tax tools we recommend here are best for people with a simple budget (get standard forms), as well as those who can benefit from standard deductions such as owning a home, childcare costs, education or student loans, a large charitable deduction, a. health savings account, or medical

Best stop loss strategy, stop loss order military, stop loss insurance carriers, stop loss military definition, military stop loss pay, loss stop, stop men's hair loss, stop-loss, stop loss health insurance, military stop, stop loss insurance services, stop loss military

0 Comments