Tsp Monthly Payments - Military Money Guide has partnered with CardRatings to cover our credit card products. Military credit and rating cards may receive commissions from card issuers. The opinions, reviews, analysis and recommendations are solely those of the author and have not been reviewed, endorsed or approved by any of these entities. Thank you for supporting my independent, patient-focused website.

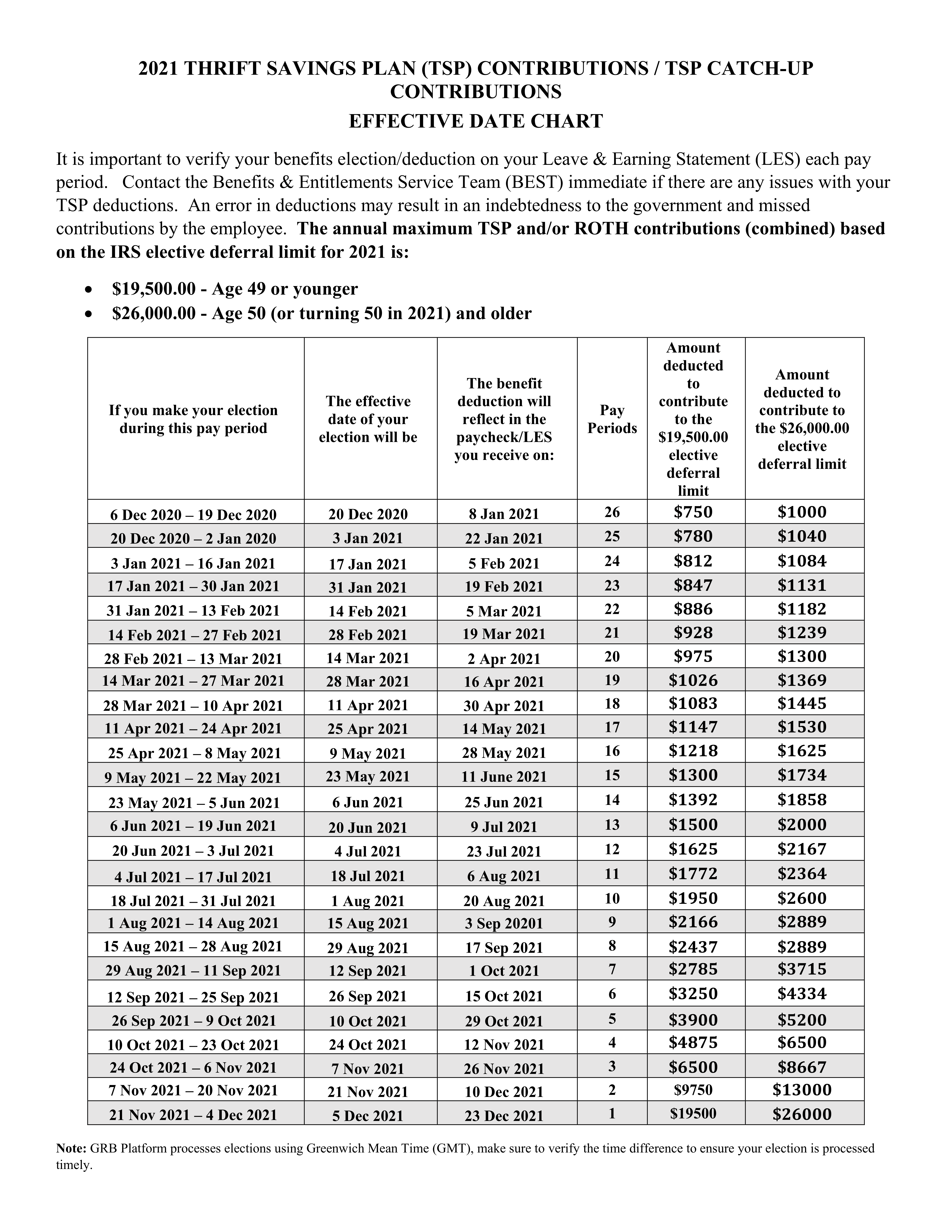

What percentage of your monthly salary must you contribute to your military savings plan through the retirement system (BRS) in order for it to grow by 2023? December.?

Tsp Monthly Payments

Here are the 2023 military TSP BRS contribution increase charts based on 2023 military pay increases and a $22,500 carryover TSP contribution.

Form: Tsp 76, Financial Hardship In Service Withdrawal Request ...: Fill Out & Sign Online

To max out your 5% Military TSP, you must contribute at least 5% per month to the TSP and you CANNOT max out until December. The easiest way to do this is to spread the payments evenly over 12 months of the year.

Military TSP matched through the Blended Retirement System (BRS) is the best way for military members to build retirement savings.

I discuss investing in a savings plan on my Military Money podcast, available on Spotify and Apple Podcasts or embedded below.

BRS allows you to earn up to 5% of your pay, so your military savings accounts (TSPs) can grow quickly. This is an improvement to the military retirement plan for the more than 80% of service members who will not receive a military pension for 20 or more years.

Thrift Savings Plan: How A Military Tsp Can Make Or Break Retirement

Due to BRS matching contributions to its traditional TSP from 2021. January 1 until December 31 i added an additional $4,600. Compounded at 7 percent over 40 years, the matching contribution grew to $68,000.

Individual retirement accounts (IRAs, both Roth and traditional) are $6,500 in 2023. $541.66 per month in a Roth or Traditional IRA.

A properly optimized BRS TSP match can cost thousands per year. The only limitation is that you have to deposit 5% every month because the profit is paid monthly.

Therefore, you don't want to pay the full $22,500 in contributions (the annual withdrawal limit) in the first six months of the year: to get the full payout, you need to calculate your contribution for the entire year.

What Is A Tsp Loan?

At the beginning of the year, I paid my TSP premiums as quickly as possible. According to BRS, this is no longer ideal, so I changed the contribution strategy.

Don't worry about going over the $22,500 annual limit. As long as you don't have another employer retirement account (401k, 403b, solo 401K), the DFAS computers will limit your final contribution to ensure you max out the account without losing a penny. 2021 and 2022 there was a bug allowing contribution or "TSP dumping" but it has been fixed.

The chart above shows the percentage you should pay monthly for all recruiting, support, and staff positions up to O-8 and 26 years of service. If you are an O-9 or have more than 28 years of service, let an assistant do the numbers for you.

If you want to increase your TSP contribution in 2022 ($22,500) and to receive the full 5% TSP to which you are entitled, you must contribute at least 5% to TSP each month.

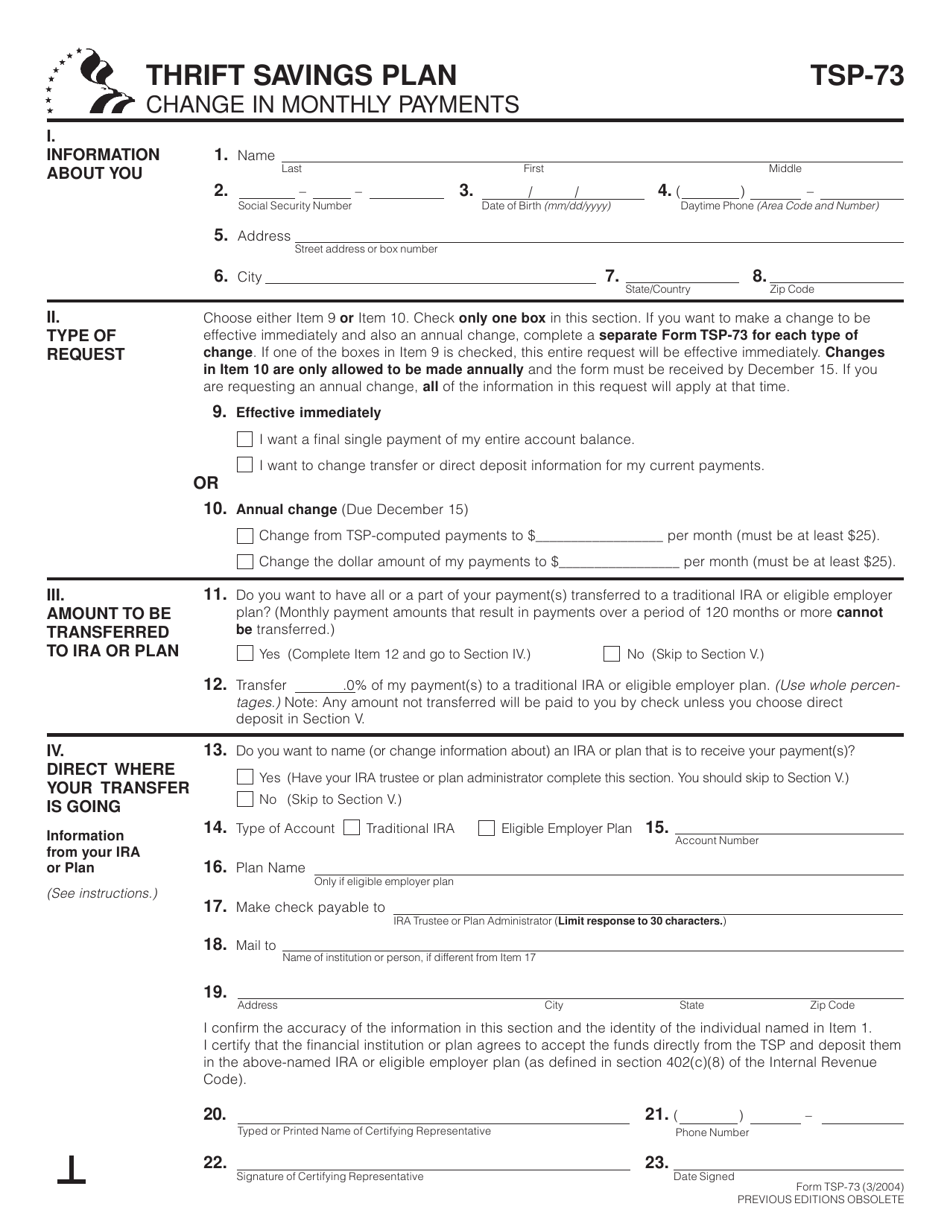

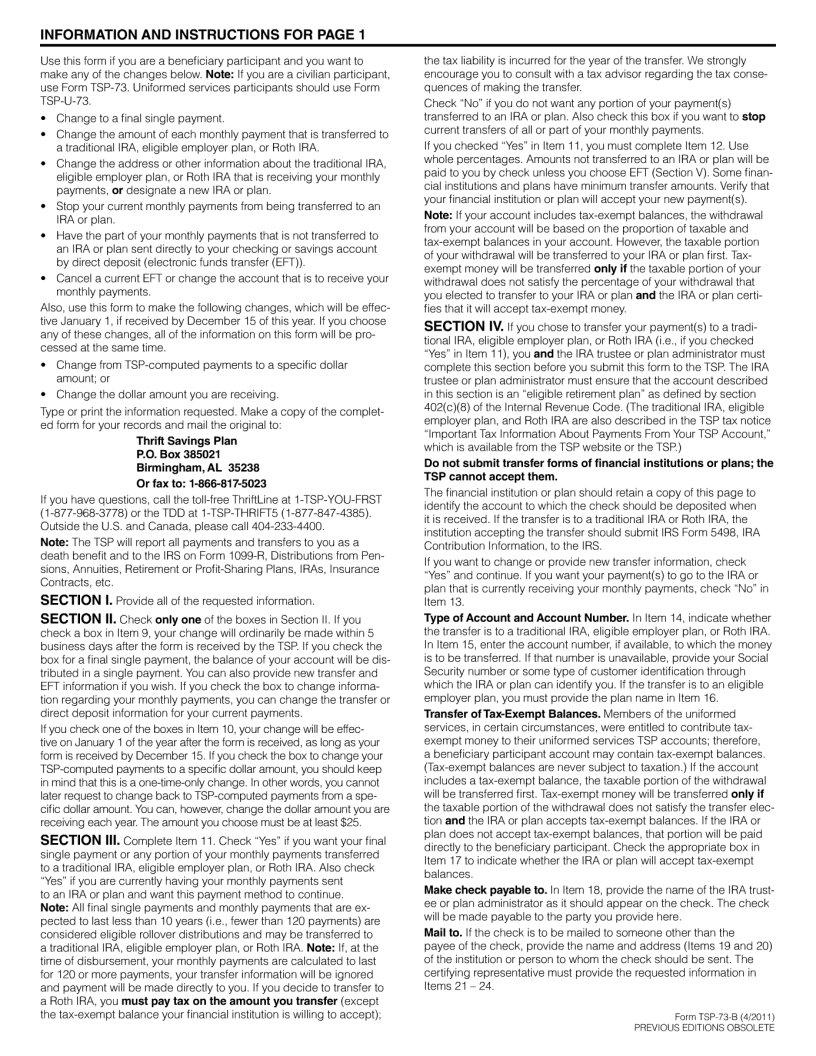

Retirement/thrift Savings Plan (tsp)

The formula is quite simple. Take the maximum contribution limit of $22,500 in 2022. Divide by 12 months = $1,875. Now divide $1,875 by the principal monthly payment to get the payment ratio.

For example, if your base salary is $5,000 per month, $1,875/5,000 = 0.375 or 37.5%. Round up to 38% because you can only choose grants in each percentage.

If you contribute 38% of your $5,000 base salary, you'll leave $1,900 each month in a TSP, Roth, or Traditional.

For tax purposes, the match always falls under the traditional TSP. You'll still get a match if you contribute to your Roth TSP, but the match will go into your traditional TSP. You can't change it. Group note

Thrift Savings Plan (tsp): The Ultimate Guide

So by 2023 in November you will have contributed $20,900 to your TSP. Your match value will be $5,000 * 0.05 = $250 per month or $3,000 for the entire year.

In 2023 In December, since you have $1,600 left in contributions ($22,500-$20,900), the TSP or DFAS computers should allow you to contribute $1,600 and the remaining $200 in December or January. Merry Christmas or end of year bonus!

You have now increased your annual contribution and are receiving a full 5% profit every month of the year.

If you contribute at least 5% of your salary to TSP under BRS, you might be surprised how much it's worth each month.

Tsp: 5 Reasons Why It's The Best Retirement Plan Ever

If you get your full BRS bonus every month this year, you could be worth thousands of dollars, depending on your salary level and hours of work. Over a few years or decades, your TSP match can grow to thousands of dollars by retirement age.

The Army automatically deposits 1% of your base pay into your Military Thrift Savings Plan account. If you contribute at least 5% of your military pay to a Roth or traditional TSP, the military will contribute another 5% to your traditional TSP. That could be worth $1,000 each year.

Yes! Roth TSP qualifies. However, the match will go to your traditional TSP account. When you open a TSP, you have two accounts in the TSP: a traditional account and a Roth account. You can subscribe to any of them and get 5% bonus from your employer every month. However, whether you subscribe to Trad or Roth, the match always goes to your traditional account.

You should put at least 5% into your TSP. If you are enlisted or below the rank of O-4 (Special, Lieutenant Commander), you should probably contribute 5% to your Roth TSP. As your income grows, you should put no more than $20,500 a year into your military TSP account and still ensure that you receive 5 percent each year.

How To Change Your Tsp Contributions In 7 Easy Steps

You can if your tax form or software asks you to report it. However, you're already paying taxes on this money before it goes into your Roth. Therefore, it does not reduce your taxable income for that year.

To top up your military TSP, you must contribute at least 5% of your salary each month from January to December. So you don't want to increase your contribution earlier this year. I have a chart on my website that will show you what percentage to contribute.

No, the standard TSP standard does not include compatibility. in 2023 you can contribute the full $22,500 and meet that limit up to an "additional annual contribution" of $66,000. The standard TSP ratio is called the "selectivity coefficient".

If you want to maximize your TSP payday contribution, you need to do some math. Take the total annual contribution of $22,500 and divide it by the number of payment periods (12). That's $1,875 a month. Divide it by your base salary to get the minimum monthly contribution to top up your TSP by December 31st.

Tsp 75 Form Printable: Fill Out & Sign Online

Tsp annuity vs monthly payments, auto repair monthly payments, monthly payments furniture, car repair monthly payments, iphone monthly payments, invisalign monthly payments, tsp payments, accept monthly payments, treadmill monthly payments, buy ipad monthly payments, buy iphone monthly payments, tsp annuity or monthly payments

0 Comments